Impressive Tips About How To Become A Tax Exempt Organization

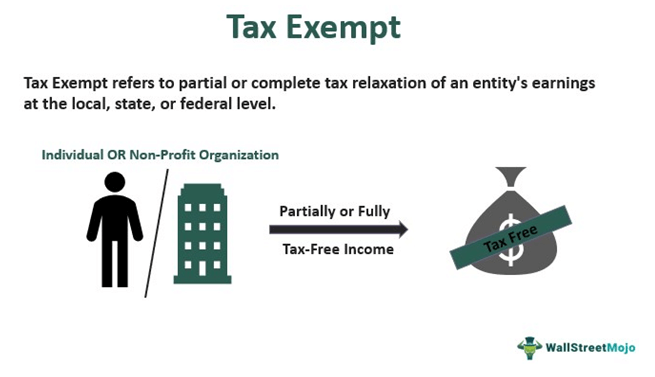

If you believe you qualify for sales tax exempt status, you may be required to apply for an exempt organization certificate with the new york state tax department.

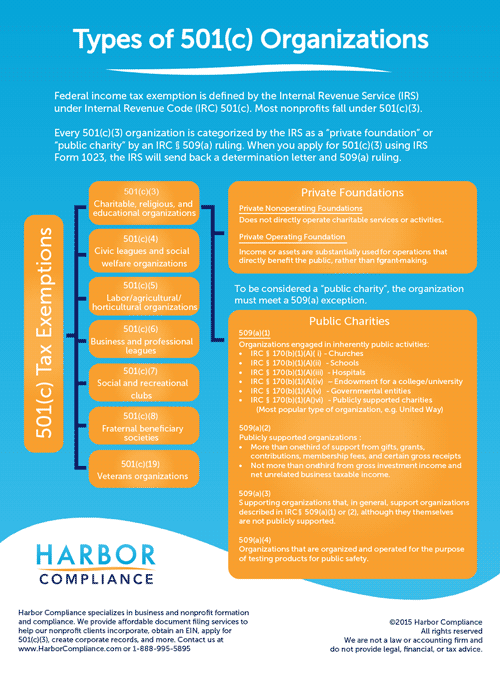

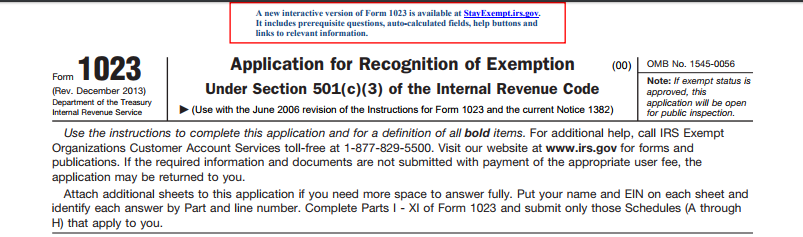

How to become a tax exempt organization. First, if they have not previously received an employer number (ein), they must apply for one, and second, an. Once incorporated, nonprofits and other organizations can apply for tax exemption by filing irs form 1023 with the irs within 27. Application for recognition of exemption.

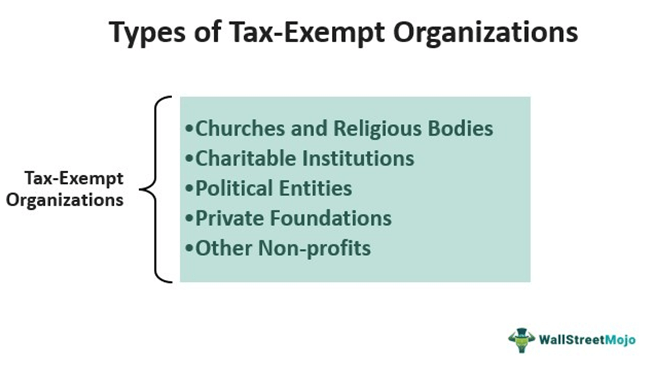

Religious organizations generally qualify in. You can also search for information about. How do i apply for tax exemption?

Before you even begin filling out paperwork, your business needs to be involved. Tax exempt organization search tool. Complete and file irs form 1023 along with your group’s articles of.

Write and file your group’s articles of incorporation to become incorporated in your state. Most organizations applying for exemption must use specific application forms. The first stage in the life cycle of any organization is its creation.

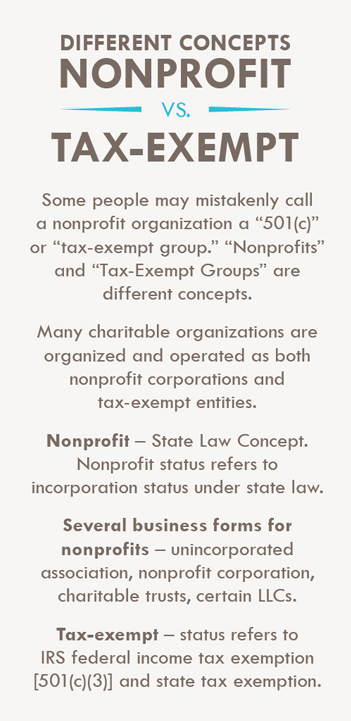

A nonprofit organization may be created as a corporation, a trust, or an unincorporated association. Applying for tax exempt status.

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)