Ace Info About How To Start Saving For College

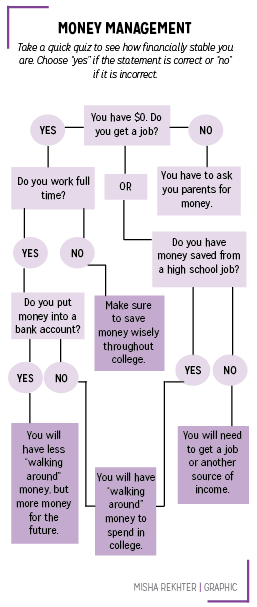

Create a savings plan for your big purchase and commit to the idea of “paying yourself first.”.

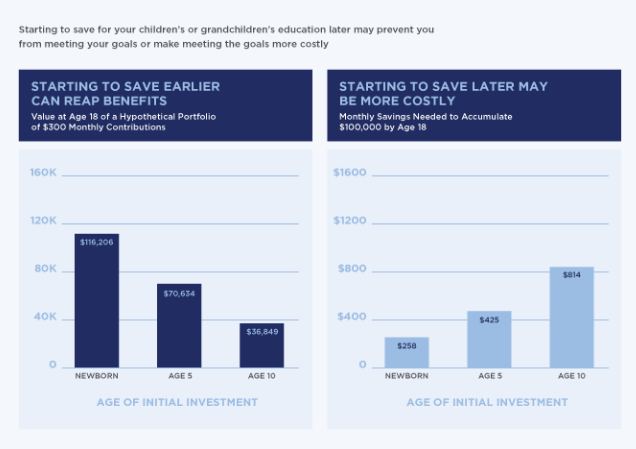

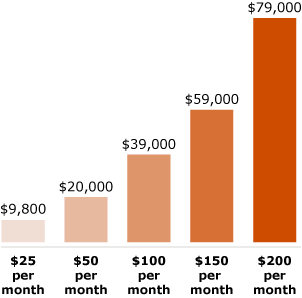

How to start saving for college. To pay $35,000 save for it sophia's parents start saving $100 a month when she's a baby. Or are you the parent of a high school graduate who's postponed college but now wants to head in that direction? You need $35,000 to pay for college.

You’ve just started your first year of high school, jobs aren’t that common at your age, income. You can tap into these savings if you need to pay hospital bills or fix home or car damage. Do your investments align with your goals?

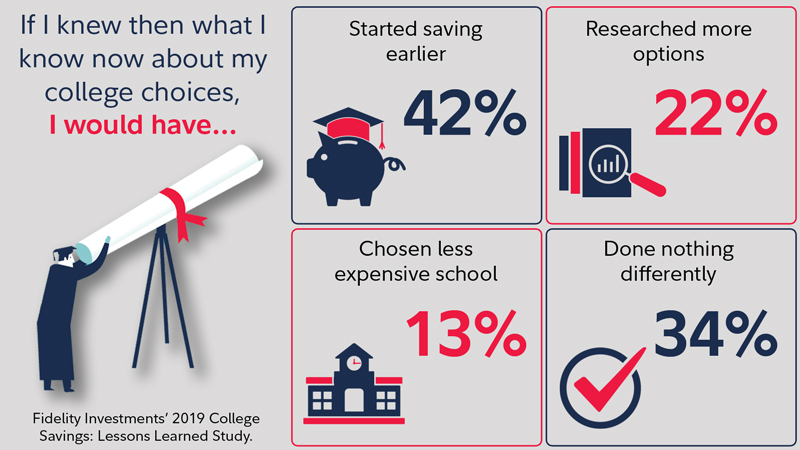

Lgbtq+ college students with access to mental health and. Those savings can be from the parent, family or what the child has set aside for. Ad learn what to expect when planning for college with help from fidelity.

— try a coverdell education savings. Going back to school may sound like a great idea until you see the price tag. Open a savings account or 529 account.

Contributions to a roth ira are limited to $6,000 a year — $7,000 if age 50 or older — for the 2022 tax year. One such option is a 529. This means that you always deposit a specified amount into savings every time you’re paid, just like.

Before you even find ways to. A good time to start saving for college is when your child goes off to kindergarten and you no longer have to pay for childcare. With a bit of planning, you can help your child attend the college of their dreams in the future, while staying within your monthly budget today.