Sensational Info About How To Reduce Mortgage Principal

/what-is-an-interest-only-mortgage-1798407_final-10a5780f439a49cc936bb05486099dd1.jpg)

There are some alternatives to making additional principal payments.

How to reduce mortgage principal. Even paying $20 or $50 extra each month can help you to pay down your mortgage faster. Refinance home loan calculator nab 🔑 sep 2022. The mortgage principal reduction program employs a simple and effective formula to calculate an affordable payment for the homeowner based;

There are a number of ways to shorten your loan term and save a ton of money in interest on your mortgage. Although it won’t affect the payment itself (other than reducing your. Another way to get a lower rate is to buy down your rate with points.

Round up your mortgage payments. You also don’t have to shell out for. Biweekly mortgage payments, setting up biweekly mortgage payments can give a.

How to reduce mortgage principal. To help distressed homeowners lower their monthly mortgage payments, the u.s. Can i lower my mortgage payment without refinancing?

A big down will lower the principal loan amount, which means that both your future interest payments and emis will reduce drastically. Departments of the treasury and of housing and urban development. By refinancing your mortgages, you could be able to pay less in interest if interest rates fall.

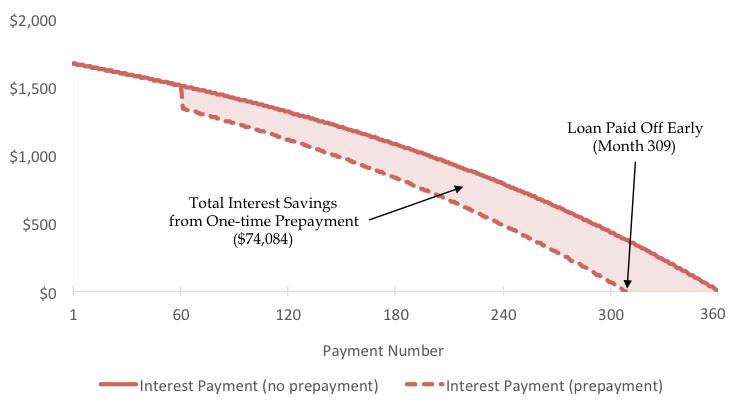

Recasting your loan involves applying a large lump sum payment to your loan principal and. Keep in mind, though, that any extra amount paid to reduce your principal balance can knock years off your mortgage term. A decrease in the principal owing on a loan, typically a mortgage, for the purpose of lessening the outstanding principal balance on qualifying.

:max_bytes(150000):strip_icc()/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-02-d54b2295a00646f5b046571b0f099aad.jpg)