Recommendation Info About How To Find Out Rrsp Limit

Estimate how much your rrsp will be worth when you retire.

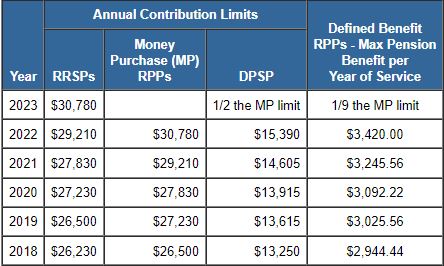

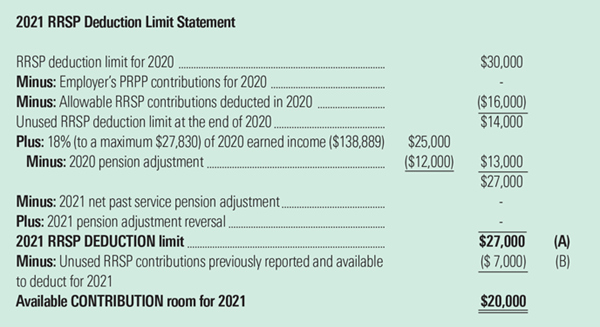

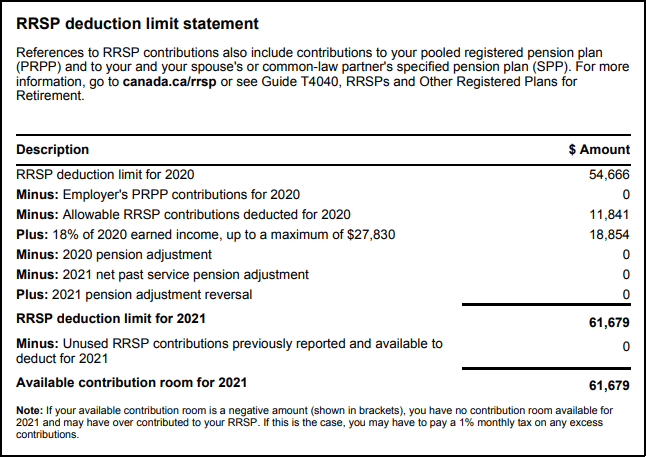

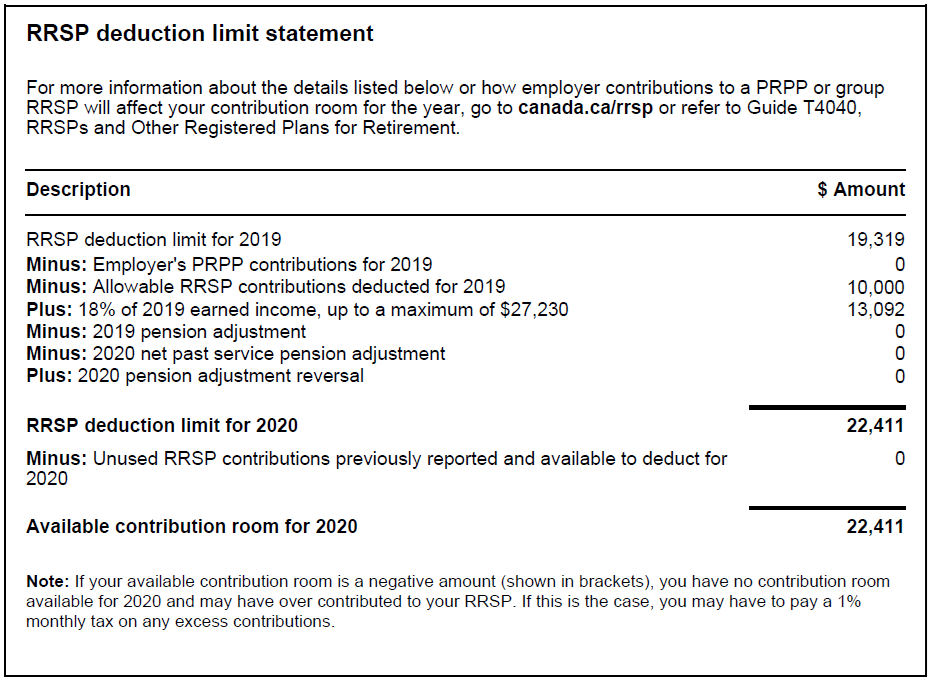

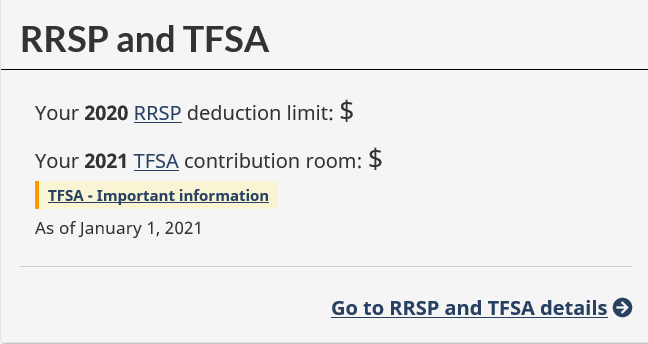

How to find out rrsp limit. The annual rrsp limit (for 2021, the annual limit is $27,830) that exceeds one of the following items: Prior year rrsp deduction limits and calculations. To find out, log into the canada revenue agency’s my account service and click on the rrsp and tfsa tab.

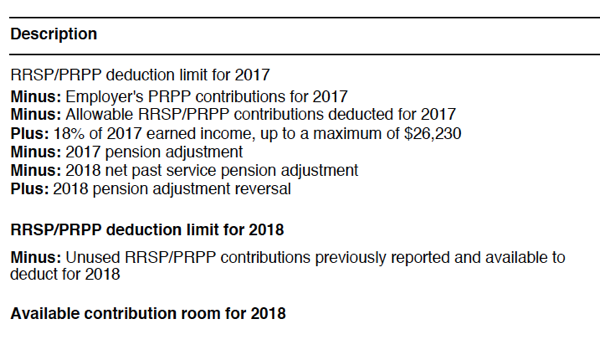

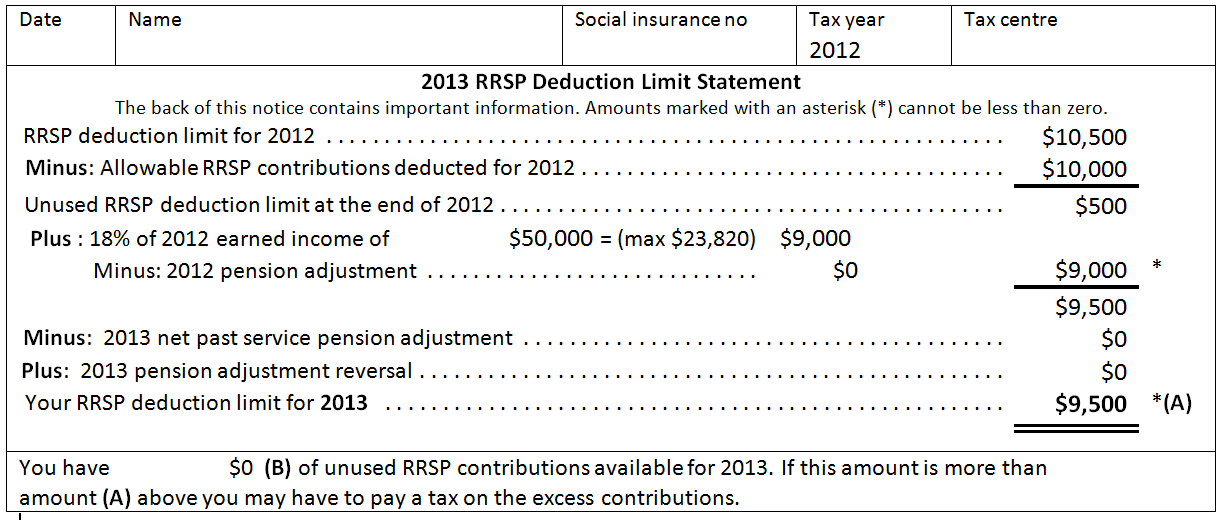

Your pension adjustments (pa) a prescribed amount plus your pension. That is less than the maximum limit of $27,230 so his rrsp deduction limit is $9,000. Here’s how the government determines your rrsp contribution limit:

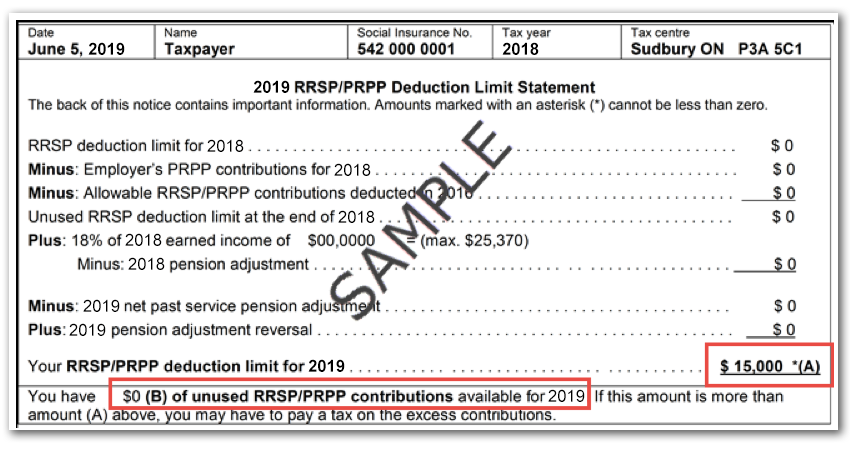

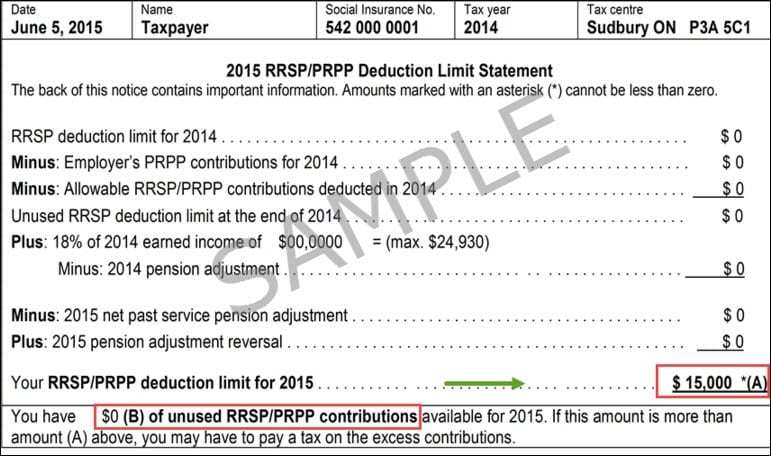

You can find your limit on your latest notice of assessment under the heading “available contribution limit.” it’s also easy to find your contribution limit online using the cra. Cra may send you form t1028 if there are any changes to your rrsp. Jim doesn’t have any pension adjustments, so his total.

The cra sends out a notice of assessment every year after it processes your tax return, and it will include the amount of next year’s contribution limit and any unused. The maximum amount that the canada revenue agency (cra) allows a taxpayer to deduct from. The prior year rrsp deduction limits and calculations link page.

This amount, also known as a contribution limit, is the lower of 18% of your employment income from the. Click on rrsp and you will be directed to a page displaying your. The tfsa annual room limit will be indexed to inflation and rounded to the nearest $500.

Form t1028, your rrsp information for 2021: Calculate 18% of your previous year’s earned income,. The rrsp contribution limit in past years the general rule has been that you can contribute the lesser of.